Little Known Facts About Retirement Income Planning.

Table of ContentsNot known Factual Statements About Retirement Income Planning Not known Details About Retirement Income Planning The Ultimate Guide To Retirement Income PlanningThe Best Guide To Retirement Income PlanningThe 6-Second Trick For Retirement Income PlanningNot known Factual Statements About Retirement Income Planning Not known Details About Retirement Income Planning

Furthermore, non-qualified annuities are funded by currently taxed money, and also only the passion made will certainly be exhausted as soon as you produce income during retired life. The consensus is that tax obligations will only raise in the future. Higher tax obligations result in much less income for the senior citizen. A non-qualified annuity decreases this threat compared to a traditional individual retirement account or individual retirement account annuity due to the fact that just the interest is tired instead of the entire quantity.Get in touch with us today for a quote if you want discovering more concerning annuities. We would certainly be pleased to go over the alternatives available and assist you discover the very best solution for your needs. Thank you for checking out! Obtain aid from a licensed financial expert. This service is complimentary of cost.

An annuity is an insurance policy item that can give a stream of settlements for a collection time period or the remainder of your life. When you acquire an annuity, you pay a round figure, as well as the providing insurance coverage company consents to make periodic payments to you, either for a collection duration or for as lengthy as you live.

Getting My Retirement Income Planning To Work

For lots of workers, a conventional pension is important to their retirement preparation. These workplace retirement strategies make use of an annuity agreement to supply lifetime income to retired workers. Pension plan benefits can be an important retired life income resource, and standard pension plans are usually among the most generous revenue sources readily available.

Defined advantage plans are certified employer-sponsored retirement strategies. Like other qualified strategies, they provide tax obligation rewards both to companies as well as to getting involved employees. Your company can usually deduct payments made to the strategy. And you normally will not owe tax on those payments till you begin getting circulations from the plan (typically throughout retired life).

A specified advantage plan assurances you a particular advantage when you retire. Just how much you get normally relies on factors such as your salary, age, as well as years of solution with the business. Yearly, pension plan actuaries calculate the future benefits that are projected to be paid from the plan, and also ultimately establish what quantity, if any, needs to be contributed to the plan to fund that projected benefit payout.

The 45-Second Trick For Retirement Income Planning

Selecting the best payment option is necessary, due to the fact that the alternative you select can affect the amount of advantage you eventually receive. You'll want to consider every one of your choices very carefully, and compare the advantage repayment amounts under each alternative. Since so much might depend upon this decision, you might intend to review your choices with a financial and also tax expert - retirement income planning.

g., 401(k) strategy, profit-sharing plan). As the name suggests, a defined advantage plan concentrates on the utmost benefits paid. Your employer assures to pay you a specific amount at retired life and is liable for making certain that there suffice funds in the plan to eventually pay out this quantity, even if strategy investments do not perform well.

Your our website strategy specifies the contribution quantity you're qualified to each year (payments made by either you or your company), but your employer is not bound to pay you a defined quantity at retirement. Instead, the quantity you obtain at retirement will depend upon the investments you choose as well as just how those financial investments carry out.

What Does Retirement Income Planning Mean?

Hybrid plans consist of specified advantage strategies that have a lot of the characteristics of specified payment plans. Among the most popular types of a crossbreed strategy is the cash money equilibrium strategy. Money equilibrium plans are specified advantage strategies that in lots of methods look like defined contribution plans. Like specified advantage strategies, they are bound to pay you a specified amount at retired life, and are guaranteed by the federal government.

It offers details concerning your firm's pension strategy and consists of vital info, such as vesting demands and settlement alternatives. Address inquiries to your plan administrator if there's anything you do not understand. Testimonial your account info, seeing to it you recognize what benefits you are qualified to. Do this occasionally, inspecting your Social Safety and security number, day of birth, as well as the compensation made use of to calculate your advantages, considering that these prevail resources of mistake.

g., marriage, separation, death of spouse). Keep an eye on the pension details for every company you have actually worked for. See to it you have copies of pension plan statements that properly show the amount of advantages you're entitled to get. Look out for adjustments. Employers are click reference permitted to change and also even end pension plans, yet you will obtain sufficient notification.

The Best Strategy To Use For Retirement Income Planning

Evaluate the effect of transforming work on your pension plan. Think about remaining with one company at the very least till you're vested. The longer you stay with one company, the extra you're most likely to obtain at retired life.

When you make a decision to take it may have a big impact on your retired life. It can be alluring to declare your benefit as soon as you're qualified for Social Securitytypically at age 62.

(Complete old age ranges from 66 to 67, depending on the year in which you were birthed - retirement income planning.) Learn your full retirement age, and also work with your financial expert to browse around these guys check out exactly how the timing of your Social Safety and security advantage fits right into your general strategy. Among the most beneficial advantages UC provides is UC's pension plan planthe UC Retirement, or UCRP.

An Unbiased View of Retirement Income Planning

You want to have a strategy that can adapt to life's unpreventable curveballs. Five years right into your retirement, you may obtain an inheritance, have your parents relocate in, or experience another substantial life event. When these points take place, you need a strategy that gives you the capability to make changes along the road.

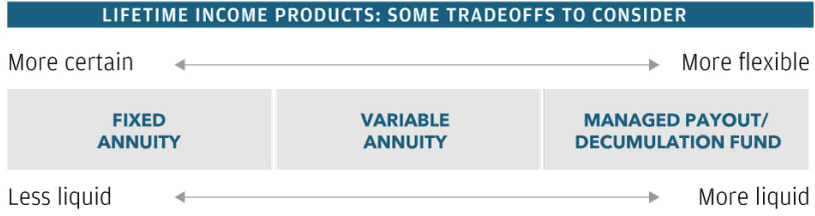

Everybody's scenario is one-of-a-kind, so there's no one income technique that will work for all financiers. You'll require to figure out the loved one importance of growth potential, guarantees, or flexibility to help you pinpoint the technique that is ideal for you in retirement.

Retirement Income Planning - Truths

Let's dive deeper into what a life insurance policy retirement (LIRP) is, exactly how LIRPs work, and also who ought to obtain this kind of retirement strategy. LIRP suggests life insurance coverage retirement as well as is not implied to change a typical retirement, like an individual retirement account or 401(k). 2 When somebody is considering a life insurance policy retirement or LIRP, they are normally referencing an irreversible life insurance policy plan.

Have a basic fatality advantage paid to a beneficiary when the insurance policy holder passes, and also the plans never run out. 5 This implies that the life insurance policy retired life plan lasts the entire life of the insurance policy holder.

This savings account can grow in time, tax-deferred, at a pre-determined rates of interest. 6 There are a few different methods this money worth can permit you to use life insurance coverage for retired life advantages: If you pick to add a greater amount to your LIRP's cash value, it can grow at a quicker speed and also offer you a more powerful structure to collaborate with later.